2024 1040 Schedule A Instructions – To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . Sole proprietors may only need the form 1040, Schedule SE for self employment Fill in each form according to the instructions, making sure no sections are skipped. In some cases you’ll need .

2024 1040 Schedule A Instructions

Source : www.incometaxgujarat.orgSchedule E Instructions: How to Fill Out Schedule E in 2024?

Source : www.noradarealestate.comIRS Unveils 2024 1040 Tax Forms, Schedules, and Instructions for 2024

Source : www.cbs42.comArizona, federal tax season begins with changes, tips for filers

Source : yourvalley.netForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgTax season is under way. Here are some tips to navigate it. | WNCT

Source : www.wnct.comTax Season is Under Way. Here Are Some Tips to Navigate It

Source : news.wttw.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

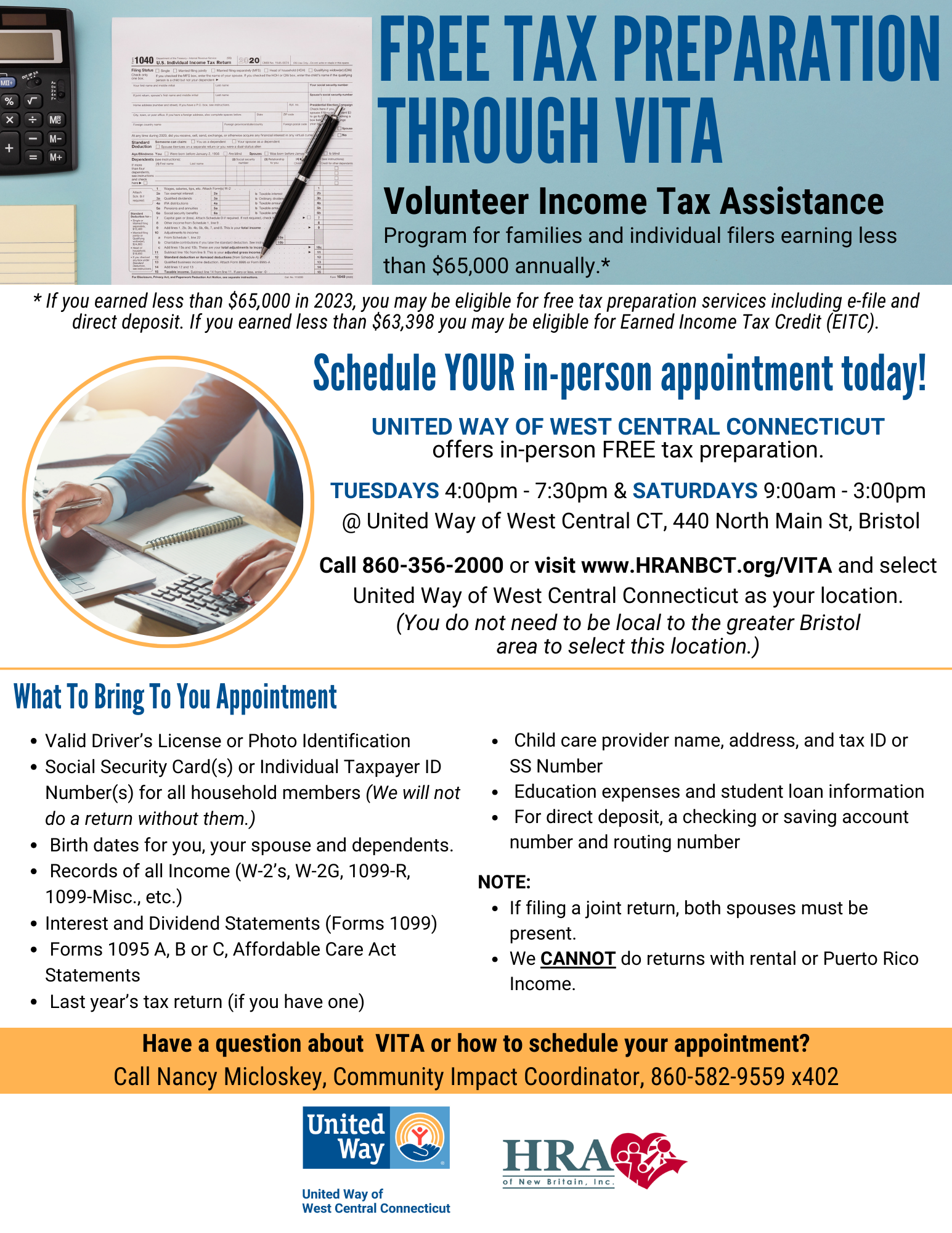

Source : www.investopedia.comFree Tax Preparation Service | United Way of West Central Connecticut

Source : www.uwwestcentralct.orgTax season begins: What to know for filing this year | Here & Now

Source : www.wbur.org2024 1040 Schedule A Instructions Form 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions : You can claim this deduction on Form 1040, Schedule A. Do you pay property taxes monthly the total amount of the credit from the mortgage interest you deduct. See the instructions page of Form . When you decide to close your sole proprietorship, there are no special instructions to follow, except what is normally required for sole proprietorships. Complete IRS 1040 Schedule C .

]]>

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)